CIMA Accredited Sage Certificate

Awarded by SAGE | Free Accredited Certificate Included | Globally Recognised | Unlimited Access for 180 Days

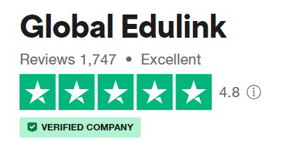

Global Edulink

Summary

Overview

CIMA Accredited Sage Certificate

Sage courses focus on accounts and payroll, and could help you to pursue the career you want, and this CIMA Accredited Sage Certificate is no different. If you have completed an introductory Sage training course and are ready to progress to a higher level, this is the course for you. Understand how sage works with accounting principles, and how the software can be used in a business environment.

This course has been carefully created in partnership with Sage UK with the Chartered Institute of Management Accountants (CIMA). The certificate will allow you to demonstrate a high level of skill, and could help you to establish your own business or progress in your current career.

Studying with Global Edulink has many advantages. The course material is delivered straight to you, and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand.

This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 180 days (6 months). An effective support service and study materials will build your confidence to study efficiently and guide you to secure your qualification.

**PLEASE NOTE: Sage 50 Software is not provided with this package. All learners are required to have purchase software separately.

Course media

Description

Course Objectives

The course comprises six units, as follows:

- How to make full use of the software, backup, restore and data security

- Transactions from customer and suppliers including invoice creation

- Cash, bank and budget control and reconciliation

- Management and comparative reporting

- VAT returns, EC sales and Intrastate

- Tailoring reports and layouts including email statements and remittances

- Project (job) costing for detailed individual job/project control

Learn about advanced accounting functions such as fixed asset control, depreciation, producing final accounts for sole traders, partnerships and limited companies.

COURSE CURRICULUM

Module 01

- Creating Customer and Supplier Account Codes and Records

- Making Error Corrections and Deleting Transactions

- Producing Sales Invoices

- Producing a Sales Credit Note

- Customer Invoices Using Batch Entry

- Customer Credit Notes Using Batch Entry

- Sales Invoice Day Book in Sage

- Sales Credit Day Book in Sage

- Entering Customer Receipts

- Printing a Customer Statement

- Supplier Invoices Using Batch Entry

- Supplier Credit Notes Using Batch Entry

- Purchase Invoice Day Book in Sage

- Purchase Credit Day Book in Sage

- Entering Supplier Payments

- Printing a Remittance Advice

- Trade and Settlement Discounts

- Setting Up and Using Email Invoice and Statement Features

Module 02

- Working Through Unit Two

- The Opening Bank Cash Book Balance (The Bank Account)

- Creating a New Bank Account

- Process Bank Transactions Not In Customers Or Suppliers Ledgers

- Transferring Money Between Accounts

- Recurring Entries

- Bank Reconciliation

- Refunds and Returned Cheques

- Contra Entries

- Petty Cash Transactions

- Reconciling the Petty Cash Account

- The Cash Register

Module 03

- Working Through Unit Three

- Entering Opening Debtor Balances

- Entering Opening Creditor Balances

- The Use of the Journal in Sage

- Making Journal Entries

- Entering Nominal Ledger Opening Balances

- Use of the Suspense Account

- Correcting Departmental Posting Errors

- Journal Entries for Direct and Indirect Labour

- Glossary of Accounting Terms

Module 04

- Screenshots, Tasks and Activities

- Working Through Unit Four

- Monitor and Analyse Customer Accounts for Credit Control

- Supplier Activities and Aged Reports

- Debtors and Creditors Control Accounts

- VAT Returns and The Government Gateway

- To Process a VAT Return

- EC Purchases and EC Sales

- EC Sales List

- Intrastat

- Bad Debt Write Off and Provision for Doubtful Debts

- The Trial Balance

- Errors in the Trial Balance

Module 05

- Working Through Unit Five

- Maintaining the Security Of Data

- Types of Backup Files and Storage

- Set Access Rights for a Secure Operating System

- Prepare and Process the Month End Routine

- Management Reporting

- Other Comparative Reports available in Sage

- Exporting Data and Linking to Other Systems

Module 06

- Working Through Unit Six

- Introduction to Costs and Income (for students)

- Cost Centres and Profit Centres

- Coding Using Sage

- Departmental Coding

- Variance Analysis

- Budget Control

- Stock Valuation and Stock Control

- Accounting for Movements in WIP and Finished Goods

- Project Costing using Cost Codes and Resources

Method of Assessment

The course is self-contained with self-assessments and practice tests, followed by a final online assessment.

Certification

Those who successfully complete this course will be awarded with the CIMA Accredited Sage Certificate.

Course Description

This online training course is comprehensive and designed to cover the topics listed under the curriculum.

PLEASE NOTE: We do not provide tutor support for this course

Requirements

Learners must be age 16 or over and should have a basic understanding of English, Maths, and ICT.

Career path

This certificate will help you in securing a progressive job opportunity in the accounting industry. Listed below are some of the job roles this course will help you secure, along with the average UK salary per annum.

- Financial Controller – £46,964 per annum

- Chartered Accountant – £35,118 per annum

- Finance Manager – £38,138 per annum

- Accountant – £28,580 per annum

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.